RB Bros have transitioned from paper-based processes to Trulend — a fully digital platform that helps them record, track, and demonstrate compliance with their Consumer Duty obligations.

"I'm using Handy Digital's TRULEND© software to ensure my finance company complies with consumer duty regulations — so far, everything's running smoothly, and the service has been excellent!"

Raymond Barker Bros successfully transitioned from a manual, paper-based workflow to a fully digitised, FCA-compliant system.

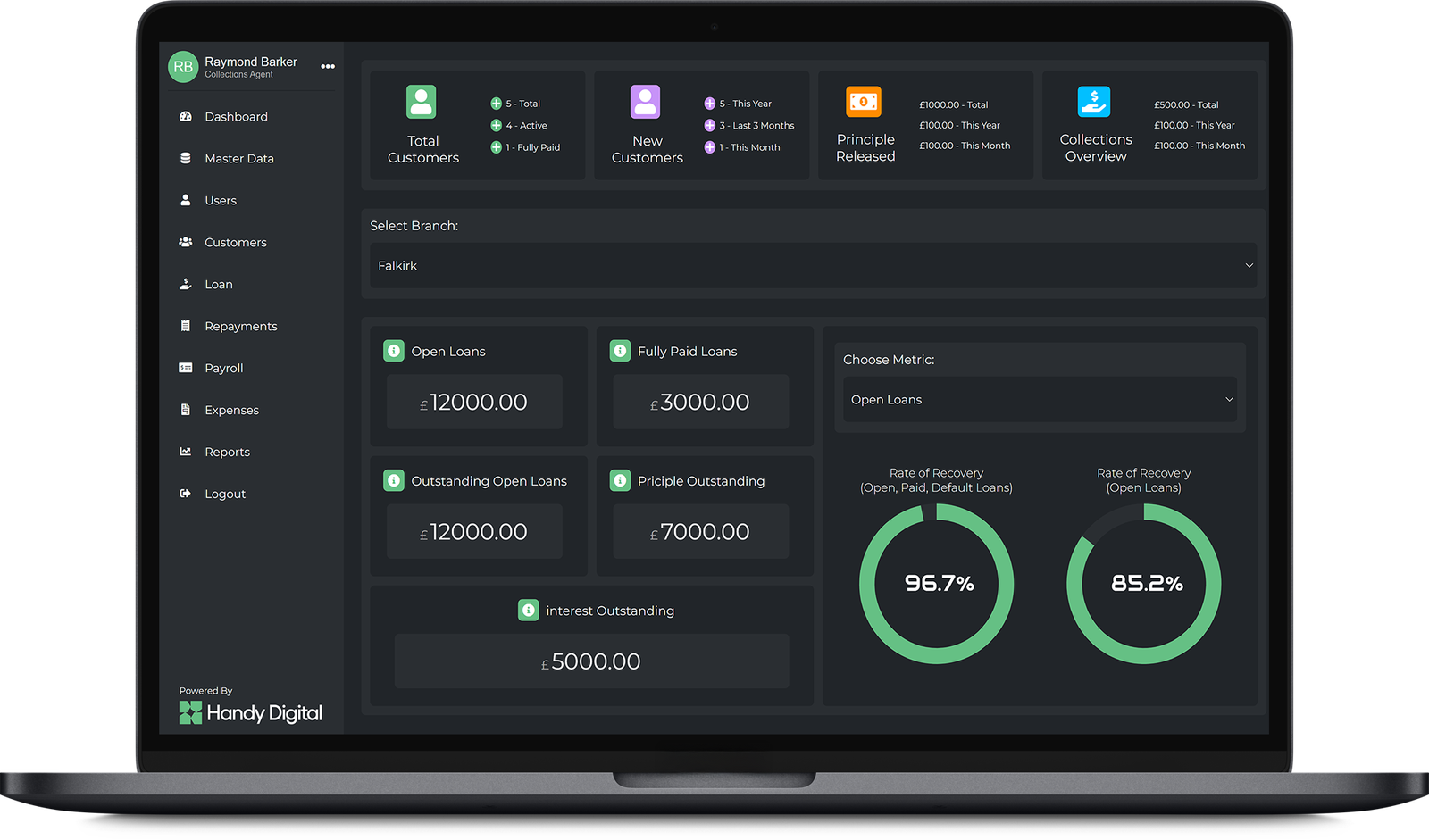

The TRULEND platform now powers their entire customer lifecycle — from lending and collections to CRM and customer self-service. With automation reducing errors and easing administrative pressure, and real-time reporting built into the platform, the company now demonstrates clear adherence to Consumer Duty principles. They’ve significantly enhanced customer transparency and experience, improved the monitoring of communications and affordability, and strengthened internal accountability while reducing regulatory risk.

Our bespoke collections app empowers field staff to operate with speed, accuracy, and full connectivity. As they visit customers, they can effortlessly log repayments, capture complaints, record reasons for missed payments, and flag any vulnerabilities — all from their device. Each entry syncs automatically with the central CRM, removing the need for manual updates and ensuring records are always accurate and current.

Meanwhile, the customer portal offers an intuitive, app-style dashboard that puts account management directly into the hands of the customer. From checking balances and repayment history to downloading documents, applying for new credit, or updating personal details — everything is just a few taps away.

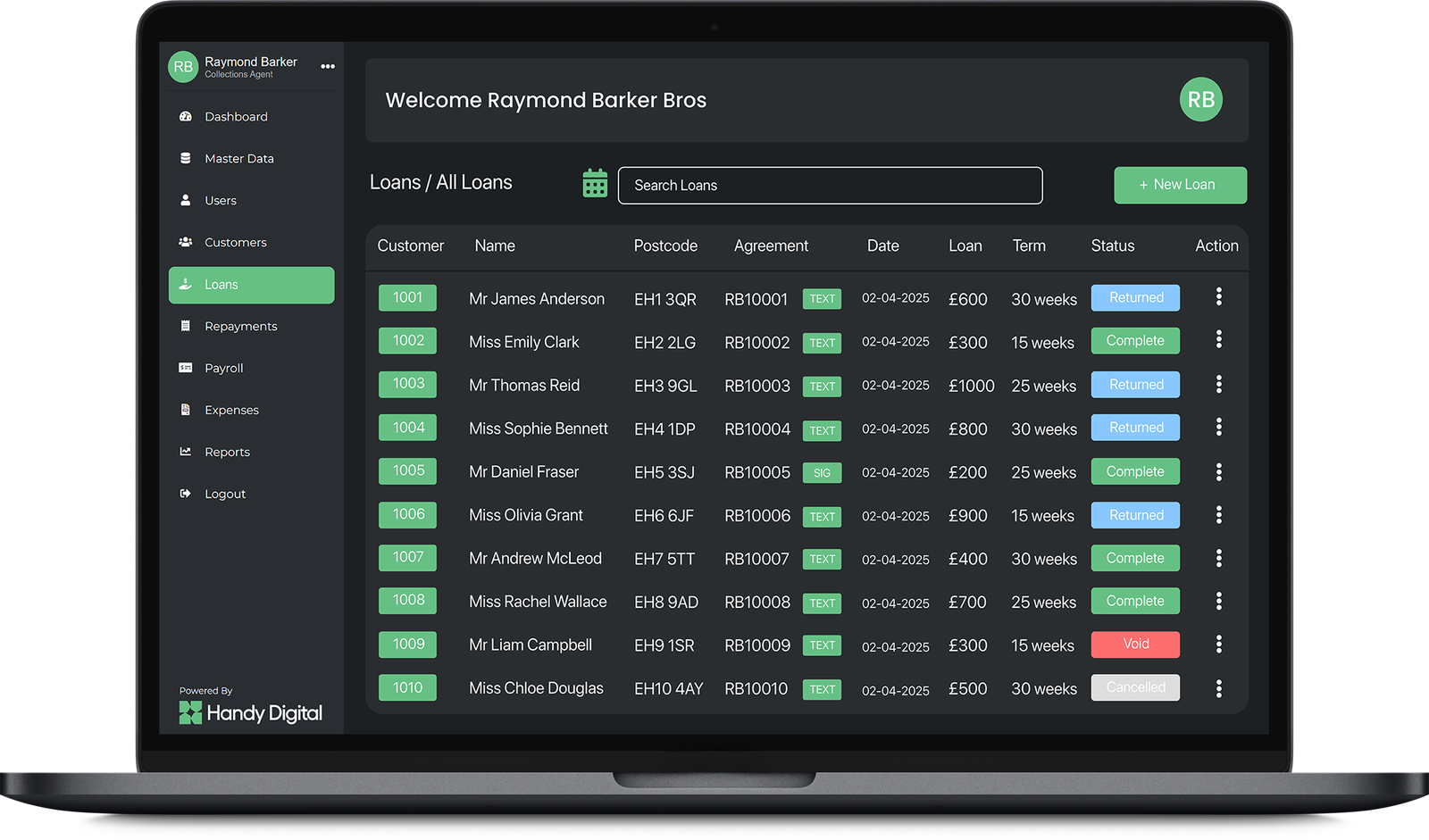

Our TRULEND platform was implemented across the business to deliver a seamless digital experience — covering every stage from customer onboarding to final repayment. Each component of the system was purpose-built to meet the requirements of FCA Consumer Duty, ensuring every process remains transparent, fair, and accountable. The platform eliminates manual paperwork, helping teams operate more efficiently while staying fully aligned with regulatory expectations.

The digital lending tools allow for paperless processing, automated document delivery, and built-in customer engagement features such as surveys and voice recording. The CRM and accounting hub provides a complete, real-time view of each customer’s history, removing the need for manual data entry. It includes tools for managing notes, tracking company expenses and payroll, and generating FCA-compliant reports — empowering teams with the data and insights they need to operate with confidence and clarity.

REACH US AT

contactus@handy-digital.com